In her previous series, Investing in Circularity, expert in sustainable fashion and circular design Amy Rauen gave us an overview of the current investments into the circular economy in the textile and sporting goods industries, as well as sharing the latest evidence that investing in circular companies is worth the risk. Now we zoom in on one aspect: End-of-life textile recycling in the sporting goods industry, and look at how this could pay off for brands as well as the environment.

The EU generates a staggering 12.6 million tonnes of textile waste annually, and clothing and footwear alone account for 5.2 million tonnes. Your brand’s proactive involvement in reducing this could have a huge significance. Presently, a mere 22 percent of post-consumer textile waste undergoes separate collection for re-use or recycling, with the rest often meeting incineration or landfills. But the EU is aiming to move towards a circular economy, which includes changing the way we handle textiles at end-of-life.

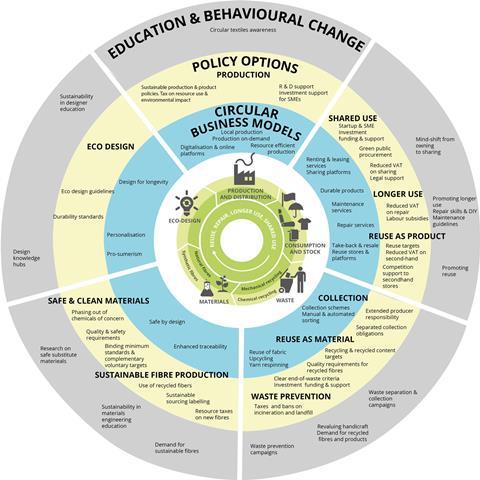

Even though the term is widely used, it’s worth recapping the meaning of “circular economy” before diving deeper into our topic. Working towards a circular economy means creating products that are intentionally designed to eliminate waste and pollution, maximize resource efficiency, and enable a continuous loop of materials and resources. It involves considering the entire lifecycle of a product, right from the moment of design: From the sourcing of raw materials to manufacturing, distribution, use, and end-of-life disposal or regeneration.

Under these principles, the circular economy is not just about the end-of-use of an item or how to recycle it. A circular economy prioritizes keeping a product at its highest value for the longest possible time until the item or components are “spent” and can no longer be reused, repaired, upcycled, or remanufactured. Only then should we consider the last steps of the technical cycle (i.e., recycling) or the biological cycle (i.e., composting or decomposition systems).

However, many sporting goods and outdoor brands are already considering the end-of-life of a product, and in particular the recycling of textiles. Perhaps because it is a visible and appreciable action, for both brands and consumers. Legislation – both existing and forthcoming – may also play a role in why textile recycling is growing in importance.

And then there are the financial motivations. As a Hey Fashion report recently summarized: “Brands that invest and act decisively on opportunities like textile-to-textile recycling will have access to abundant, affordable recycled materials and establish themselves as leaders in sustainable fashion. Those not taking meaningful action will be locked out of this new era of fashion and will struggle against incoming legislation and rising consumer demands.”

To make sure that sporting goods and outdoor brands can reap the financial, and of course, environmental rewards of textile recycling, this article will look at the process in more detail, give you five ways sporting goods brands can begin to incorporate textile-to-textile recycling, and explain some broader strategy considerations.

Table of Contents:

- Textile recycling. It all begins with design

- Breaking down the textile recycling process

- The financial potential of textile recycling

- How textile recycling will pay off for brands too

- 5 ways brands can drive textile recycling progress

- 5 business strategies to end textile waste

Textile recycling: It all begins with design

In reality, end-of-life textile recycling begins at the very beginning of a garment’s life, with design. There are some key challenges or barriers that designers face when trying to incorporate circularity.

The first significant challenge is ensuring material cyclability. In a circular economy, we want to reduce the need for virgin resources. To achieve this, it’s crucial that all components of a product, including threads and trims, align with either the mechanical or biological end-of-life processes. Products should be designed to be either recycled through mechanical or chemical processes, or to decompose and biodegrade biologically.

Natural fibers like cotton, viscose, and hemp are well-suited for the bio-cycle, while synthetic fibers such as rPET and regenerated nylon are preferred for the technical cycle. Innovative circular fibers like Infinna and Agraloop, derived from waste-to-fiber processes, offer additional options.

Linked to this is another challenge: Disassembly. Implementing disassembly techniques like manually separable seams (e.g., the chain-stitch) or utilizing heat dissolvable threads (e.g., Resortecs) can greatly enhance the ease of recycling, as well as enabling the repairability and reusability of garments and their components.

Prioritizing mono-material garments over multiple material blends is key to enable textile recycling. This keeps all materials at their highest quality and value. Consistency and simplicity are also important. Every material and trim, including buttons, thread, and size and care labels should match the main material of the garment and its recycling cycle for efficient processing.

In order to facilitate end-of-life textile recycling, it is crucial for designers to stay well-informed about sustainable materials, technologies, and certifications. Collaborating with suppliers, manufacturers, and industry experts who share the same circular vision is also vital. It’s also important to fully understand the textile recycling process.

Breaking down the textile recycling process

There are three stages to utilize and prepare textiles for recycling:

-

Stage 1: Collecting post-consumer used textiles, post-industrial feedstock, or pre-consumer feedstock

-

Stage 2: Sorting

-

Stage 3: Preprocessing

Stage 1: Collecting

Post-industrial textiles, which are the simplest to recycle, come from textile manufacturing facilities such as fabric mills and cut and sew facilities. Because they are easily identified, easily sorted, and typically do not need pre-processing, these materials are a valuable resource and most in demand by recyclers.

Pre-consumer feedstocks consist of apparel and fabrics made but not sold, including overruns or overstocks. They may be the result of several drivers: Products not meeting specifications, unreliable forecasting methodologies, and complicated value chains resulting in over buys and over runs.

Post-consumer feedstocks are the third and largest volume of feedstock. They are based on collection channels including donation bins, thrift stores and branded take back programs.

Stage 2: Sorting

Post-consumer and pre-consumer garments that cannot be (re-)sold go through a commercial sorting process and are separated by color, construction, and fiber composition. Because this process is labor intensive and almost entirely manual, most of these materials are shipped to low wage countries for sorting. But new technologies, from mechanical sorting systems to NIR (near infrared) fiber identification systems are in development and at trial stages.

Stage 3: Preprocessing

Preprocessing currently creates a major bottleneck in the textile recycling process. This is where each garment is disassembled, with non-fiber components that obstruct the recycling process such as zippers, buttons, mixed-fiber trims and thick screen prints removed.

Garments with laminated fabrics, seam sealing, PU coatings, or high elastane content are generally not recycled through existing processes. As a designer, you need to know whether the coatings, DWR films, finishes, and prints you are incorporating are recyclable or not.

The infrastructure for these operations is not at scale yet but there are pilots underway to help get this to be a profit center instead of a loss.

The financial potential of textile recycling

Textile recycling is not only a good decision environmentally speaking, an investment in textile recycling is also a good business decision. Many case studies are currently underway to help determine the exact ROI.

In 2021, I participated in the Ellen MacArthur “From Linear to Circular Certificate” program. Our team was given a challenge by one of the biggest traders of secondhand goods, Bank & Vogue, who have the opportunity to source post-consumer textiles for chemical and mechanical recycling at scale. They asked for our help to prove these programs are scalable, profitable, and hugely environmentally beneficial.

Our findings concluded that there was a potential profit of close to $19,699 per container (40,000 lbs of used textile) from a cotton fiber-to-fiber scheme for sorting post-consumer textiles scraps down to the spent textile level.1

For polyester, we found there was a potential profit of $648.00 per container load if sorted down to the spent textile level.2

Of course, these numbers are estimates based on the current market price in a specific region and more validation is needed to confirm them, but this approach highlights the ability to articulate potential sorter revenue for any fabric type with the correct inputs. And while this shows cotton as potentially more profitable than polyester now, we also found the supply for polyester to be rising and thus the need to sort and overall demand will only continue to increase.

Textile recycling will pay off for brands too

According to the Hey Fashion report: “To unlock the huge potential of textile-to-textile recycling, large-scale investment is needed globally throughout the value chain, particularly in collection and sorting.” The report adds: “Private investment plays a central role to deliver the scale of investment required.”

By investing in textile-to-textile recycling, brands position themselves to access cutting-edge recycled materials, gaining an important competitive advantage in the market. Investors supporting material innovations can help to catalyze progress.

Brands can also enhance cost-effectiveness and scalability, by supporting recyclers and directly collecting textiles from consumers, either through in-store collection boxes or mail-in options.

Gain even deeper insights into Circularity.

Unlock premium insights with The Outdoor Industry Compass’s 30-day trial for just €9,90. Access exclusive data and analyses on circularity in the outdoor industry. Subscribe now to elevate your strategy with intelligence that empowers decision-makers.

Subscribe now

Offtake agreements, where brands commit to purchasing a predetermined volume of recycled textile fiber, empower recyclers to expand production confidently, ensuring sustained demand.

According to McKinsey’s The State of Fashion 2022 report, 60 percent of fashion executives have already invested or plan to invest in closed-loop recycling in 2021.

These commitments, like offtake agreements, allow recyclers to plan production capacity, providing time for factory expansion. Such agreements also serve to demonstrate market demand to investors and shareholders, aiding in scaling recycling technologies successfully.

5 ways brands can drive the textile recycling progress:

-

Collaborate extensively across sectors: Fostering procurement teams’ involvement in sourcing innovative materials and using mono-materials.

-

Forge industry-wide collaborative partnerships: Sharing knowledge, successes, and failures can collectively advance the sector. Partner with recycling experts to streamline processes, optimizing both efficiency and cost-effectiveness.

-

Leverage economies of scale: Pool purchase orders for recycled fibers or yarns either directly with other brands or through coalitions of brands, suppliers, manufacturers, and recyclers. This can enable brands of all sizes to access niche or high-volume materials.

-

Actively engage in pre-competitive collaboration with peers and suppliers.

-

Stay informed and advocate: Monitor legislative developments closely. Engage in industry advocacy efforts to influence policies that align with your brand’s sustainability goals. Your voice matters in shaping a more responsible industry landscape.

Investing in Circularity: A Fortune for the Future

Leading economic institutes indicate a swing towards environmentally friendly and circular economy models in capital expenditure, reflected in various sectors including innovative fibers, vegan leather substitutes, and booming second-hand platforms.

Read more

5 business strategies to end textile waste

Of course, as your brand navigates these strategies, it’s worth considering some key insights to effectively steer your brand towards textile-to-textile recycling and eventually circularity. It’s important to understand that the role of a senior leader extends beyond mere business operations – it involves being catalysts for sustainable change.

-

The financial landscape: Transitioning to regenerative or recycled materials is essential for circularity, however, cost disparities and availability challenges exist upstream. Meeting cost targets necessitates creative solutions, including leveraging incentives like preferred tariffs for eco-friendly fibers and utilizing eco-modulation frameworks.

-

Engage the right stakeholders: Engaging key stakeholders, especially CFOs, is pivotal. Ensuring that financial leadership aligns with sustainability goals can drive meaningful change. Overcoming traditional quarterly earnings models and marketing budgets favoring new consumption patterns will require innovative thinking and a shift toward circular ideals. Get them on board, both their knowledge and support is crucial.

-

Optimizing planning: Strategically plan to avoid excess inventory at the end of a season. This doesn’t mean sacrificing profits; rather, it entails realistic forecasting. A high sell-through rate, exceeding 90 percent, is a hallmark of sustainability.

-

Private analysis for public impact: Privately analyze your products’ recyclability using today’s technology. Understand how much of what you produce is inherently recyclable due to its materials. Highlight how your customer can responsibly dispose of their product once they are finished using it. Provide them with the resources and the opportunity to make eco-conscious choices by keeping products at their highest value and out of landfills.

-

Quantify the impact: Understand your impact by tracking how much product you produce and import into each country. Start by tracking by weight. Identify the environmental footprint of your products, especially potential landfill waste. Quantifying these aspects drives accountability and informed decision-making. The ability to assess, analyze, and adapt will prepare your brand for upcoming regulations and position you to make informed decisions.

Within these strategies lies the opportunity to shape a future where sporting and outdoor goods perform a pivotal role in preserving our environment. And as we witness the emergence of Extended Producer Responsibility (EPR) bills and other legislative changes, your proactive engagement and strategic planning will be critical in staying ahead of the curve.

You can steer your brand toward a future where performance goes hand in hand with responsible practices. As the sporting goods and outdoor industries shift towards a more sustainable future, your brand’s leadership will not only be instrumental but also inspirational; driving positive change but also future-proofing your brand in an evolving industry.

Amy Rauen is a sustainable fashion and circular design strategist who partners with lifestyle brands to help them incorporate innovative technologies, sustainability, and circularity into their organizations. As founder of Circular Intention – a consultancy that is reimagining how we make products – along with being a Circular Economy Pioneer through the Ellen MacArthur Foundation, she advises brands looking to effectively increase their brand equity whilst driving responsible business profits all while focusing on reducing overconsumption and overproduction.

1 Assuming an average price point per kg of cloth cotton waste for industrial use in the Indian market of $0.54 per kilo, or $1.08 per lb.↩

2 Assuming a material price point of $0.13 per lb from the average value of PET textile bales sold after sorting in Asian markets at 90-98% polyester.↩